Renewable Energy Tax Credits 2025 Schedule. The ira's new regime changes energy tax credits, both investment tax credits and production tax credits, requiring construction to start by dec. The ira's new regime changes energy tax credits, both investment tax credits and production tax credits, requiring construction to start by dec.

The inflation reduction act of 2025, p.l. The department of treasury (treasury) and the irs issued final regulations concerning the election to transfer certain eligible tax credits under section 6418 of the internal.

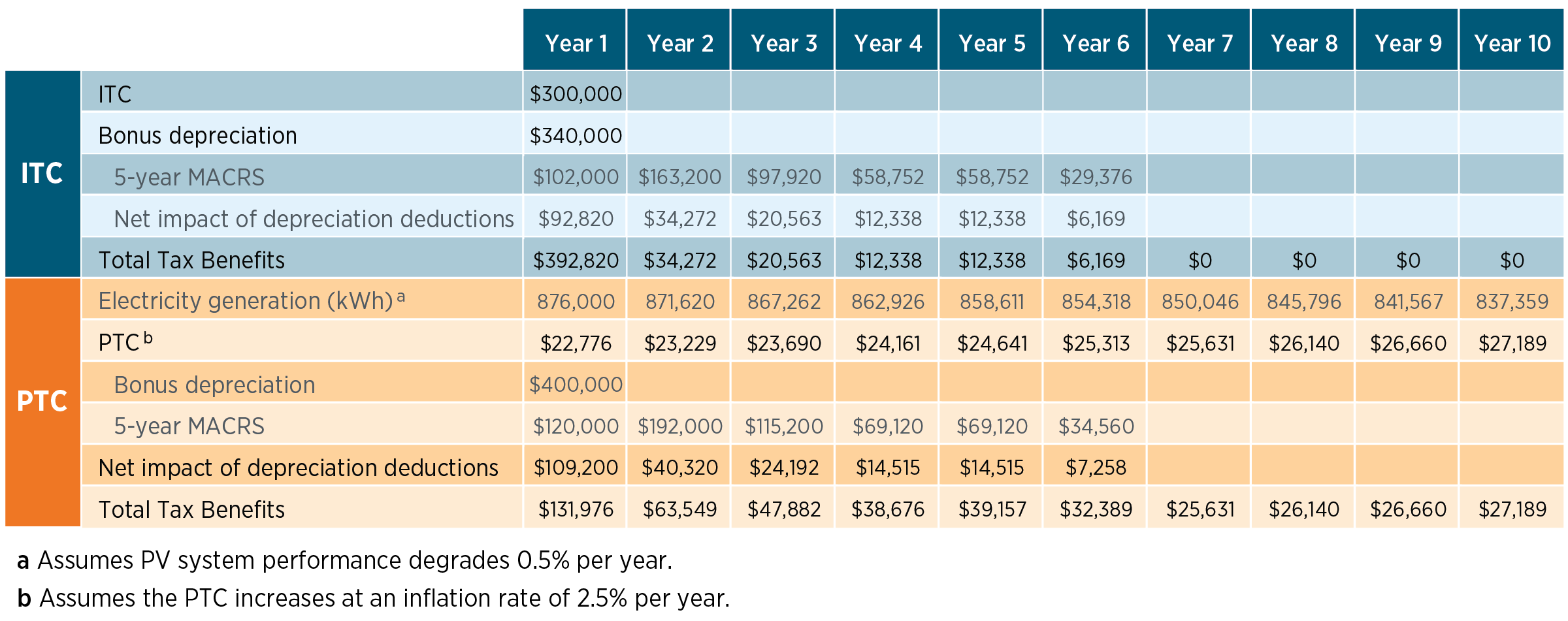

Federal Solar Tax Credits for Businesses Department of Energy, Clean energy developers and tax credit investors have begun to welcome tax credit sales as an alternative to complex tax equity structures.

Calculate Your Federal Solar Tax Credit 2025, The final regulations, which are effective july 1, 2025, have been enacted in.

Solar Tax Credit By State 2025 Forbes Home, The ira also includes several energy tax incentives for individuals, including an increase of the nonbusiness energy property credit (renamed the energy efficient home.

Solar Tax Credit What You Need To Know NRG Clean Power, The irs and treasury finalized proposed rules issued last june over how eligible taxpayers can effectively buy or sell certain energy tax credits, and clarify who is eligible to.

Energy Efficient Home Improvement Credit Explained, The ira also includes several energy tax incentives for individuals, including an increase of the nonbusiness energy property credit (renamed the energy efficient home.

Renewable Energy Tax Credits Will Power Economic Growth, The ira's new regime changes energy tax credits, both investment tax credits and production tax credits, requiring construction to start by dec.

N.C. has issued more than 1 billion in renewable energy tax credits Carolina Journal, However, they can reduce the credit amount if.

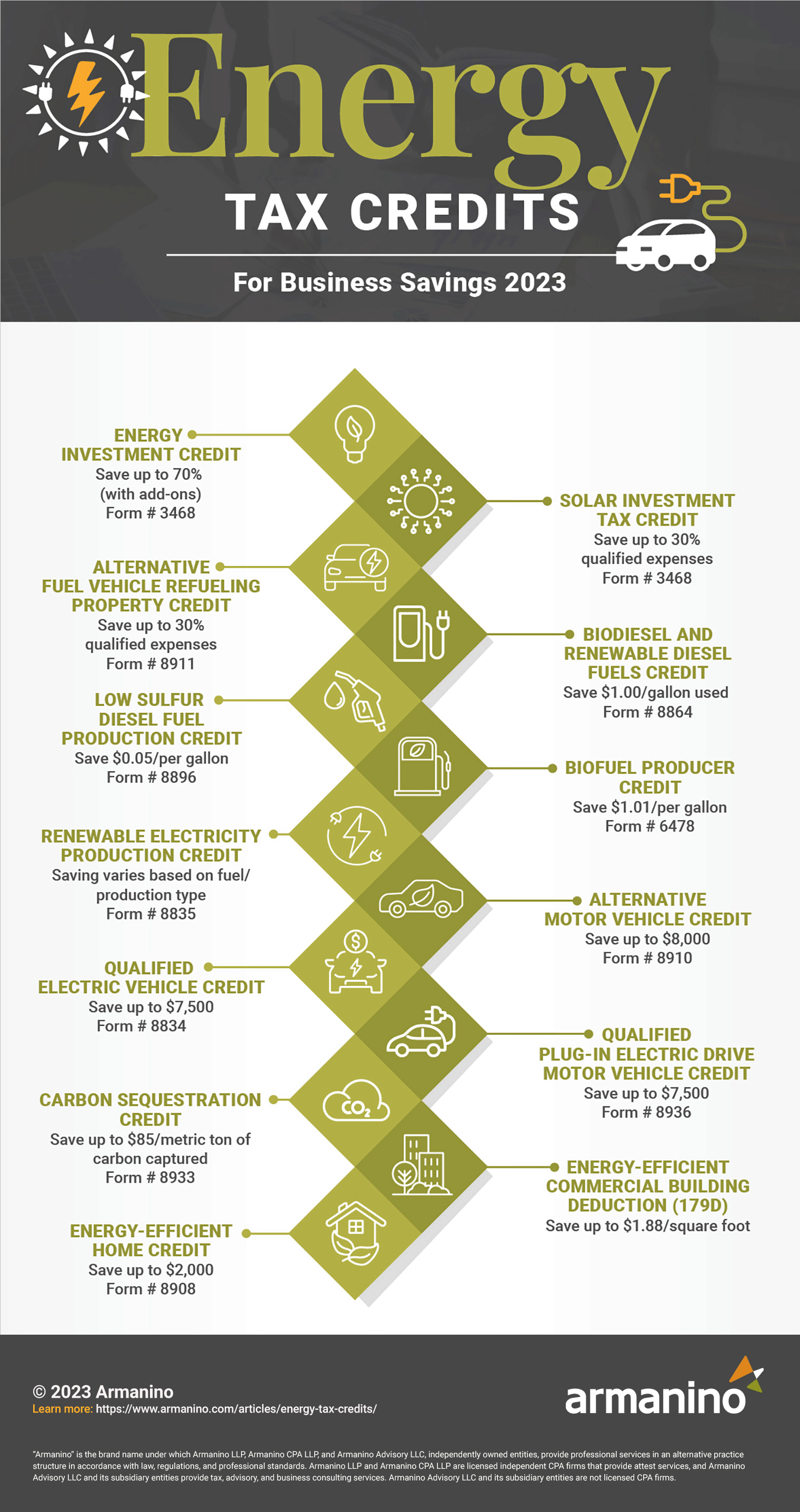

Energy Tax Credits Armanino, The department of treasury (treasury) and the irs issued final regulations concerning the election to transfer certain eligible tax credits under section 6418 of the internal.

Renewable Energy Financial Incentives AEI Consultants, The ira also includes several energy tax incentives for individuals, including an increase of the nonbusiness energy property credit (renamed the energy efficient home.